As we initiate this the new year, we have been receiving many inquiries about our outlook for 2024. We have been analyzing the market and are pleased to share our positive perspective based on several key factors:

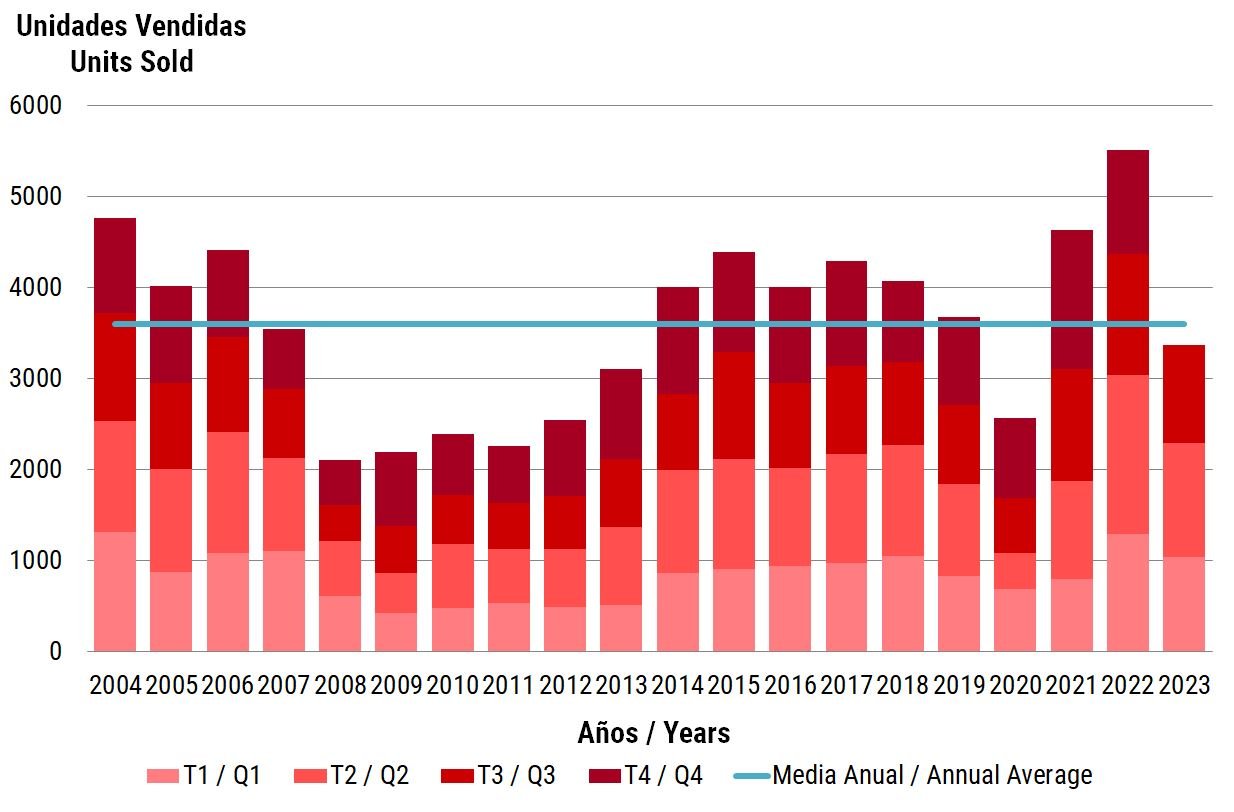

1. Resilient performance in 2023 showing a positive outlook despite transaction decline. Despite a 23.7% decrease in annual closed transactions compared to 2022, 2023 has proven to be a solid year for the real estate market in Marbella. This decline, though significant, should be viewed in context, as it positions 2023 above the average for the past two decades.

2. Prices in Marbella and Benahavis show signs of moderation. In our recent newsletter, we highlighted that second-hand home closing prices are exhibiting a more restrained increase, as indicated by official third-quarter data from 2023. Current information from the real estate portal Idealista from January 2024 asking prices reveals a downward trend in smaller municipalities, while prime locations maintain stability (see info attached for Benahavis).

This moderation in prices is a positive development, potentially enticing more buyers back into the market.

3. Euribor decline unlocks affordability and signals market positivity. The Euribor mortgage index rate is on a downward trajectory, standing at 3.686% in January 2024 compared to the peak of 4.16% in October 2023. This not only enhances afforda-bility for buyers but also signals a favorable shift in the index, anticipating additional reductions, as predicted by different bank analysts, throughout 2024 and 2025, providing a two-year window with increased acquisition capacity.

4. Anticipated Interest Rate reductions can be a boost for real estate in 2024. Analysts anticipate a reduction in the European Central Bank's official interest rate in June, marking another positive signal for the market. The more moderate inflation rate of 2.8% in January 2024, compared to the double-digit figures at the end of 2022, supports this forecast. Lower interest rates will alleviate mortgage costs and positively impact the real estate market.

5. Affordability metrics are weathering challenges in the Spanish real estate landscape. Despite a 2.25% increase in the affordability rate in Spain over the past two years, it remains at 33%, still 1% below the average of the last two decades. While rising prices and interest rates have had some impact, it is not anticipated to significantly affect the market, particularly the high-end segment on the Costa del Sol.

6. Steady inventory maintains equilibrium in Marbella & Benahavis. The inventory remains balanced and relatively low. Although price increases may push off some buyers, the limited supply of properties will likely prevent significant price declines, contributing to a stable market.

In summary, our optimism for the Marbella & Benahavis real estate market in 2024 is grounded in these positive indicators. Despite geopolitical uncertainties, including conflicts in Ukraine and Gaza and U.S. elections, we believe that the market, supported by the factors mentioned above, will exhibit resilience. Notably, our January activities have shown moderate engagement, defying the typical quietness associated with this time of year.