When you sell your primary residence in Spain and you use that amount, reinvesting, to buy your new primary residence or to refurbish what is going to be your new primary residence, the capital gained in the sale is exempted of paying taxes. However, if you do not reinvest the whole amount obtained, the capital not used to buy a new residence will pay taxes. We will first detailed how he capital gain tax is calculated to know how much you can save and then we will state the requirements for that saving.

Capital Gain Tax

The capital gain tax levies the capital gained when selling your home. The capital gained is the difference between the acquisition value and the transfer value. The acquisition value is, in general, defined as the buying price plus the investments and upgrades on the property plus the purchase costs. The transfer value is the selling price minus the selling costs. All the deductible costs have to be backed with proper invoices.

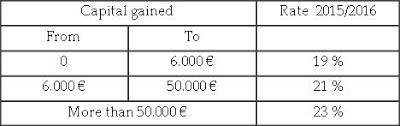

Once you have the capital gained, the tax is calculated using the rates of the following table:

That is the tax you may save when you invest the capital gained when selling your primary residence.

Requirements for the exemption

- The property sold has to be your primary residence. That means that the property has to be your permanent residence for at least three years prior to the sale. If it is a new property bought to be your primary residence, you have to move in within the twelve months after the purchase and stay in that property for at least three years.

- The buying or refurbishing of the new primary residence has to be performed two years before or after the selling of the previous primary residence.

** In any case, if the seller is older than sixty five years, the capital gained when selling his/her primary residence is exempted of paying taxes.

Since each particular case is different, it is fully recommended that you check your own details with your lawyer.