There are mainly two taxes involved when selling a property in Spain: Capital Gain Tax and Plusvalia (Council) Tax. This article is going to refer only to the Capital Gain Tax while the Plusvalia Tax will be discussed in a coming Newsletter.

Spanish capital gains tax is complex. It is paid by residents of Spain on their worldwide assets and by non-residents on property that they own in Spain. The main home of Spanish residents can be exempt depending on your situation.

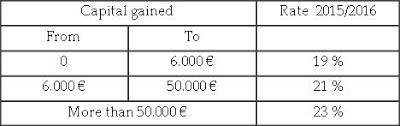

Capital Gains Tax Rates

From 2007, gains made on the sale or transfer of assets, whether moveable or immovable assets, are taxed as “savings income” – so gains are added to your other savings income for the year and then taxed accordingly. From 1st January 2010 the tax was 19% on the first €6,000 of savings income and 21% thereafter. As part of Spain’s austerity measures an additional contribution has been added to the tax rates for 2012 and 2013. The total savings income (including gains) tax rates for 2012 are therefore: up to 6.000 € the rate is 21%, from 6.000 € to 24.000 € the rate is 25% and over 24.000 € the rate is 27%.

Capital Gains on the Sale of Property

In addition to the cost of acquisition, lawyer and real estate agent invoices, expenditure on improving or enhancing the property are allowable as a deduction when calculating the net gain (selling price minus acquisition cost), and there is an "indexation co-efficient" that increases the allowable costs for inflation, based on how long the property has been owned.

Reductions

There may be reductions available depending on whether you acquired the property before or after 31 December 1994 and whether or not it was sold after 20 January 2006. If you bought your property after 31 December 1994, the gains are taxed in full (subject to the main home relief/exemption – see below). Where a property acquired before 31 December 1994 was sold prior to 20 January 2006, the full gain was reduced by 11.1% for every year (or part-year) owned prior to 31 December 1994 - so property acquired before 31 December 1986 was wholly tax free. Where the asset was acquired before 31 December 1994 and is disposed of on or after 20th January 2006, the gain needs to be time-apportioned into: the gain arising before 20 January 2006, and the gain accruing from that date. The reduction is only available on the portion of the gain accruing before 20 January 2006. Gains accruing from 20 January 2006 are taxed in full. Gains are treated as accruing evenly throughout the period of ownership.

Main home relief/exemption if under 65

Reinvestment relief is available to Spanish residents when they sell their main home and invest in a new one. To qualify for this relief, the property must be your main residence and you must have lived in it continuously for at least three years (less if you had to sell because of a change of job, marriage etc.) from the date of sale or completion. You must then buy a new main residence within four years, starting two years before the sale. The tax relief is based on the proportion of the sale proceeds reinvested into the new home. If the new home costs more than the sale price of the old home, then all of the gain is exempt. If only 50% of the sale proceeds are reinvested, then only half of the gain is exempt. If the property being sold has a mortgage on it, then it is the net sale proceeds that need to be fully reinvested to escape capital gains tax. In order for the reinvestment relief to apply, the taxpayer must declare the gain on their Spanish tax return together with their intention to reinvest the proceeds into a new main home. If the required declarations are not made, the relief is likely to be denied by the Spanish tax authorities. Note that reinvestment relief is only available to Spanish tax residents (you will need to have registered as a resident and be paying tax locally). However the main residence does not need to be in Spain to qualify for the relief, nor does the new home.

Main home exemption if over 65

If, as above, you have lived in the property as your main home for three years or more, if you are over 65 years of old when you sell it, the gains are exempt from capital gains tax even if you do not buy a new property. Again, you must be able to show you have been tax resident in Spain.

Sale of property by non-residents

When property is sold by a non-resident of Spain, purchasers must withhold 3% of the purchase price (not the gain) and pay it over to the Spanish tax authorities as an advance payment of capital gains tax on behalf of the vendor. If this is not paid, the purchaser can be fined and the unpaid tax becomes a charge over the property itself. If this 3% exceeds the tax due on the gain, a repayment will be made of the excess; however, if the tax due is more than the retained amount, further tax will be due in Spain. The vendor must file a Spanish tax return on the transaction within three months of the sale before any repayment can be made. If a person is not resident in Spain, tax may also be due in the country where they are resident, subject to any Double Taxation Treaty Relief.

Since each particular case is different, it is fully recommended that you check your own numbers with your lawyer.

Source: angloinfo.com