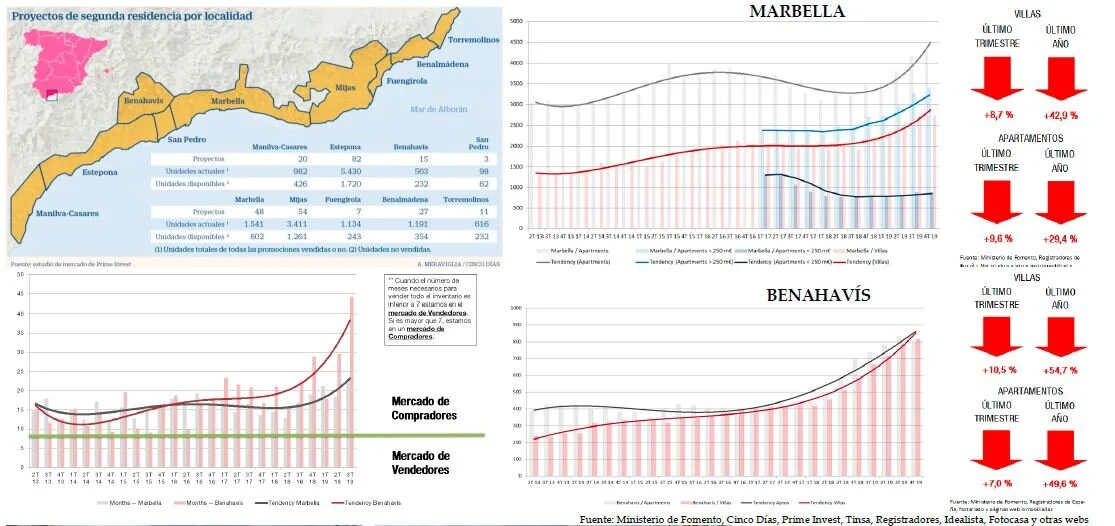

I have been talking for some time about the excess of inventory, or number of properties for sale, and after seeing an article about the saturation of new building projects in the Costa del Sol in the economic newspaper CINCO DIAS, I thought it was convenient to combine this information with the content I estimate every quarter. As you can see on the charts below, there is an excessive increase in the number of properties for sale in Marbella and Benahavis for the market to be healthy. The market is not able to absorb the units that are being offered to potential buyers and, therefore, the inventory keeps on rising. What are the consequences of this excess? In fact, this situation makes the market slower: more properties for sale and less sales (it is already a fact that the number of sale is dropping down and we can feel it every day) makes the market much more competitive when selling, and prices may be affected. Buyers have a large number of properties available, they have time and that results in a delay of the buying decision. The urgency for buying is reduced, therefore increasing the absorption rate, ie the time required to sell the whole inventory, as it can be seen on the chart below. This makes the situation even more complicated. In summary, more offer and less demand makes the market unstable and turn it into a clear Buyers’ Market where the excess of offer allows pressure on the sellers to reduce prices. I also agree with the CINCO DIAS article in the fact that there is a real demand for properties but buyers are buying at competitive prices and not at “whatever price” vendors are asking for. High prices may drive away buyers that are not able to find what they are looking for at their price level.