In the latest report from the Ministry of Housing, the numbers are in for home sales in the second quarter of 2023, and they reveal a notable 26% decrease in closed transactions for both Marbella and Benahavis. Naturally, this may raise some questions about the state of the real estate market in these areas. Let's break down the key insights:

1.- Interpreting the Numbers: A 26% decline in closed sales might appear substantial, but its significance becomes clearer when we consider the context. We're comparing these figures to the exceptional year of 2022 when historical records for home sales were set. In that extraordinary year, we witnessed an impressive surge, with Marbella's sales soaring by +53% and Benahavis by an astonishing +91% above the average annual transaction count in these regions. While these percentage drops are significant, it's important to note that the first half of 2023 still ranks as the second or third best first half in the real estate history of Marbella and Benahavis. This suggests that while 2023 might not match the remarkable performance of 2022, the real estate market in these municipalities maintains a healthy level of activity.

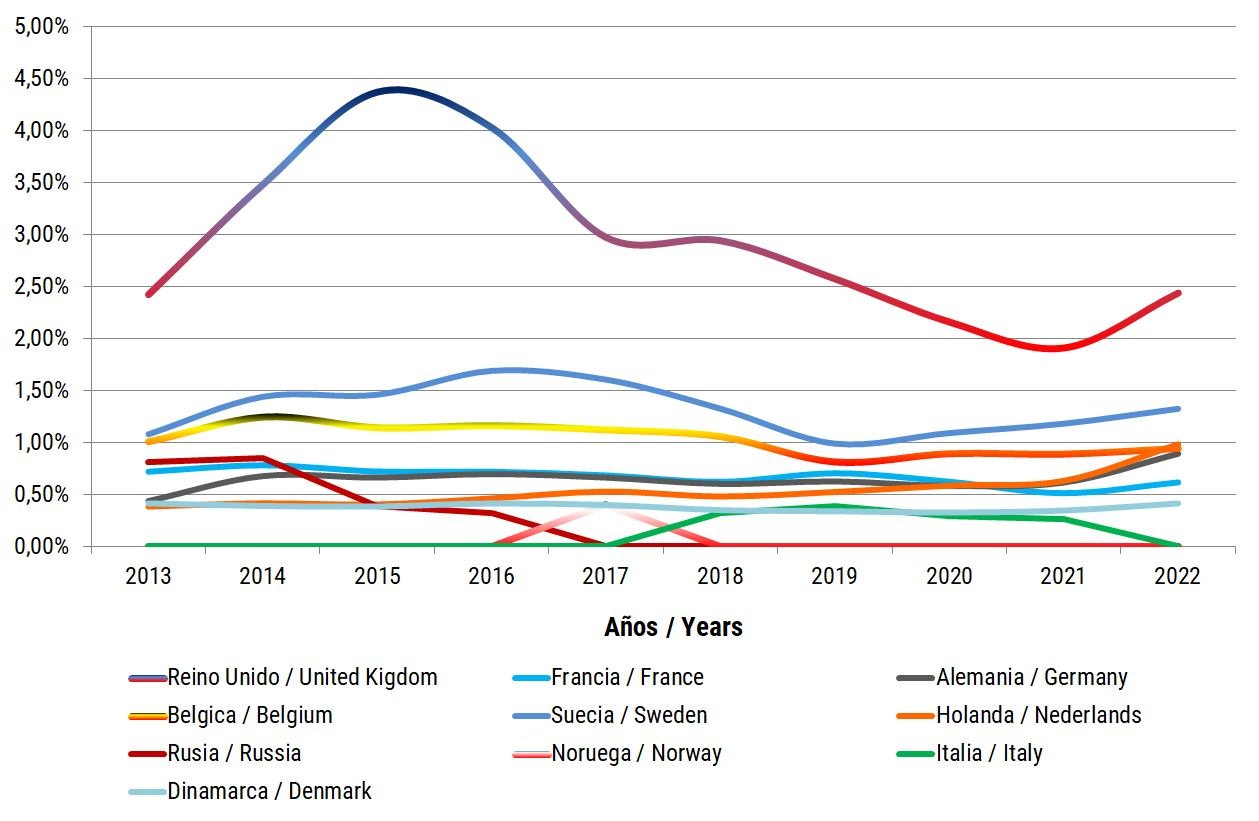

2.- Looking Ahead: A crucial question arises: Will this trend continue? It's true that we are currently experiencing a cooling in the demand for properties, possibly due to global uncertainties and rising interest rates. However, it's important to remember that Marbella, Benahavis, and the entire Costa del Sol remain highly sought-after destinations in Europe, thanks to their exceptional lifestyle offerings. So, despite a temporary dip in property demand, we anticipate a resurgence in demand once the global situation stabilizes and improves.

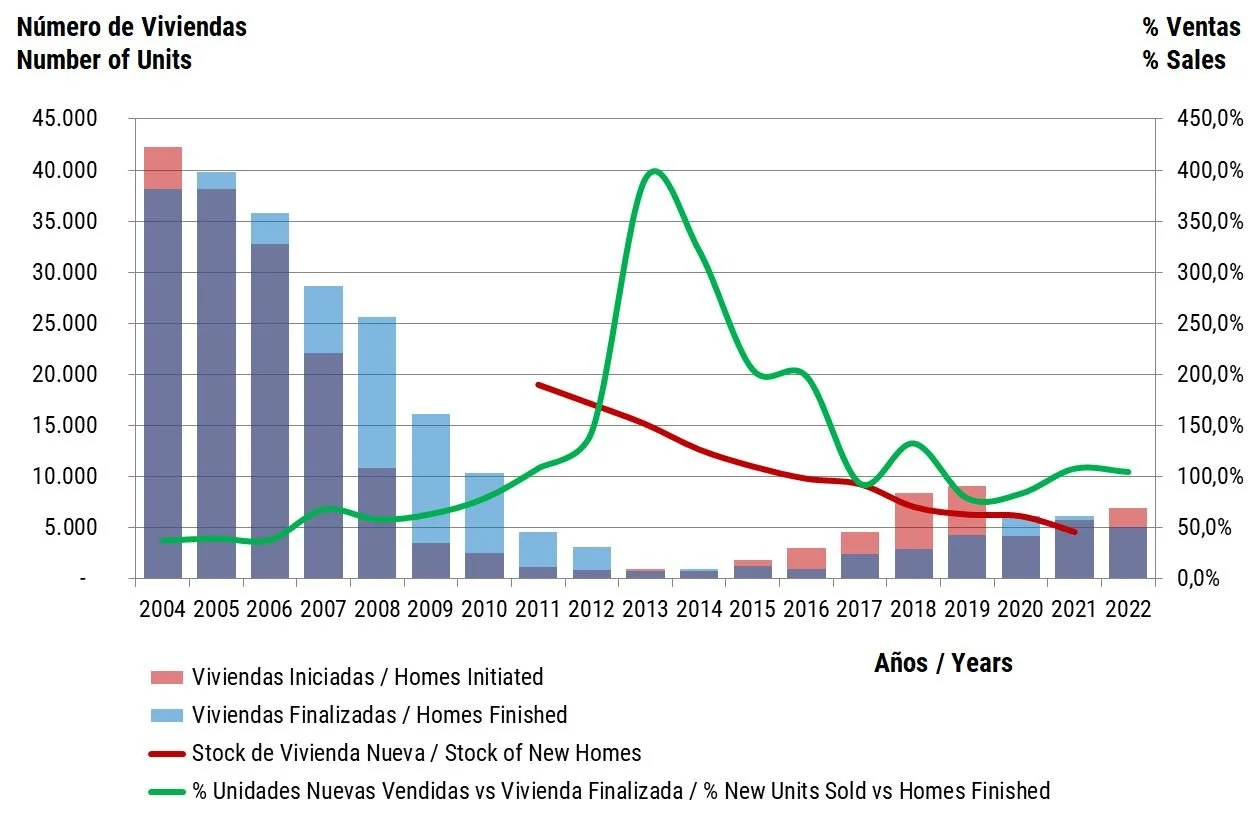

3.- Distinguishing Trends: An interesting nuance can be observed in the sales of new versus second-hand properties. In Marbella, the primary drop in closings is affecting the sale of new builds, accounting for 8% of sales, and seeing a notable 73% decrease. In contrast, Benahavis is experiencing a 40% increase in the sales of new units, while sales of second-hand properties have decreased more significantly, by 32,7%.

In summary, although there is a 26% decline in home sales, the real estate market in Marbella and Benahavis remains active. The first half of 2023 is still among the top-performing first halves in the history of these municipalities. The second half of the year, which we expect may show more cooling, will ultimately determine how 2023 concludes. Despite current challenges, the outlook for future years remains positive.